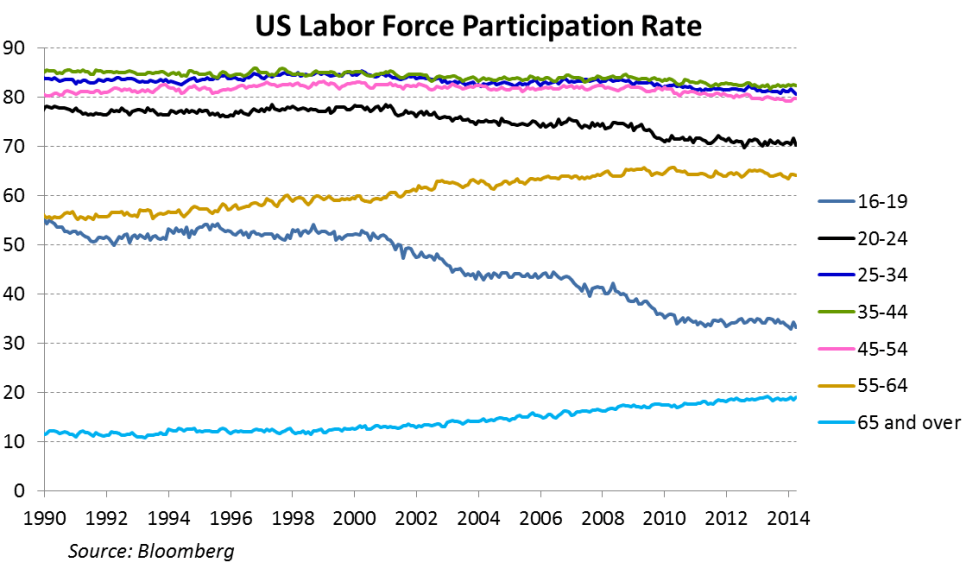

In a time where more high school students are pursuing a college degree on the undergraduate and graduate level, some detrimental circumstances have remained constant; increase in tuition & labor force participation. According to Milliman, “oustanding student loan debt increased from approximately $250 Billion to $900 Billion (2003-2011) ). Now that we’re in the year 2014, experts believe this number has now reached an estimate of $1.1 Trillion! According to Forbes via Bloomber, tuition has risen 538% since the year 1985. I’ll repeat that: 538% since 1985. This staggering statistic alone could solely hinder the current generation of graduating students, however, this is not the only problem current college generation students face. Since America’s most recent financial crisis, job employment and labor force participation among college students has not recovered back to its normal rate. This means college students are finding it harder to work in jobs that used to be more easily accessible. Not only is job employment down, but the jobs some college graduates are getting don’t necessarily even require a degree. Sam Diedrich writes:

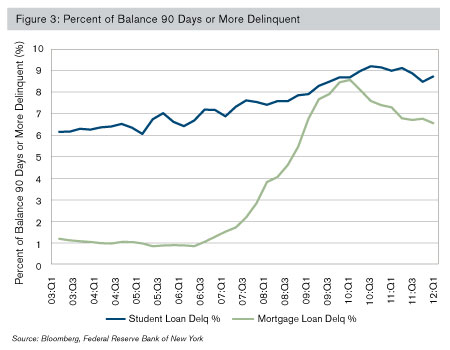

–“Students are not able to earn as much income either during college or prior to entering college, which may have offset the need for some of their borrowing. Furthermore, given the lack of job opportunities available for this age group, many are choosing to attend college rather than enter the workforce, thus increasing college enrollment and the need for borrowing. Finally, college graduates are finding it hard to find gainful employment. Lower post-graduate incomes means lower repayment rates, which in turn means higher aggregate loan balances.

One could argue that, given the poor employment prospects, enrolling in college to improve ones’ skills is exactly the right path for young people. This makes sense as long as the skills gained lead to higher productivity/employment upon graduation and, for a large number of students, this is certainly true. Disturbingly though, there are indications that this will not be the case for a good portion of college grads. Job growth projections from the Bureau of Labor Statistics report that only around 27% of new jobs created over the next ten years will require a degree. Additionally many graduates today are taking jobs that do not require a degree. For example, currently more than one million college grads work in retail. This seems to suggest that some of this increased ‘investment’ in tuition costs may not pay off, at least in the short run.

Another critical factor is the availability of loans. Student loans balances are growing because there is a lender willing to lend the capital. While growth in private loans has been stagnant, the growth in Federal loan programs has expanded tremendously since the crisis. Interest rates have remained fairly low as well. This availability of cheap credit has helped to fuel the growth in loan balances.”–

Availability of Loans + Increase of College Tuition + Low Employment Rate + Inflated Market + Low Labor Force Participation Rate For College Students = A Recipe For Disaster

Do you see America ever fixing this troublesome problem for society? A few weeks ago we wrote about the increase of master degrees in universities throughout this U.S. Even though one may think this is good news, the problem is more jobs are not only being created, but the ones that are available are making it even harder by raising the experience and qualification requirements per job. Needless to say, an intervention is mandatory or else this current college generation will bear the hefty price of paying loans for the rest of their life. Who wants to do that?! We hope this situation will be relieved very soon!