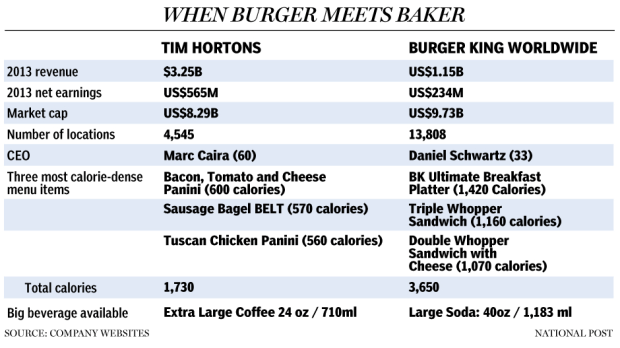

Burger King announced yesterday that it reached an agreement to purchase Canadian coffee/breakfast chain Tim Hortons Inc. for an estimated $11 BILLION!! This “inversion” is intended to give Burger King a stronger presence in the coffee and breakfast market in not only America, but in International markets around the world. This major move also means that the Burger King corporate headquarters will now operate in Canada, which will help lower Burger King’s taxes. As we have touched on major company inversions before with Walgreens; this deal has come under scrutiny from Congress & President Obama because of the future loss of tax revenue from the fast-food conglomerate. Burger King & Tim Hortons stated that the chains will continue to run independently and that Burger King will still operate out of Miami, Florida.

Despite the perception of this move from critics as a way to avoid taxes, this deal is expected to help Burger King tap into the coffee/breakfast & create some serious competition with other major players in the coffee industry, mainly McDonald’s and Starbucks. The deal also is another step in plans to expand its business globally in other markets that Burger King has yet to access; something that McDonalds has excelled at with over 35,000 stores around the world. In case you haven’t noticed, breakfast and coffee have been in high demand in the fast-food industry these past couple of years. Famous fast food staples like Wendy’s & Taco Bell have all recently jumped into the breakfast food market to “Keep up with the Jones” of major fast food companies. This increased demand for breakfast also plays as a platform into the coffee business, which both coincide with each other and has been a weakness of Burger King when compared to other competitors. This deal apparently was so big that Warren Buffett’s Berkshire Hathaway had to step in to help finance the deal just to make it official. Since we have already touched on one major company denying an Inversion for its “Reputation” how do you feel that another major company deciding to go forth with an inversion to try and maximize its profits while avoiding taxes in the US?